Brain tumour patient had Centrelink payments suspended while in hospital recovering from surgery. doubling income tax relief for median income earners and guaranteeing that taxpayers earning.. Income limit. You will satisfy the Income requirement if your accepted adjusted taxable income is less than: $30000 if you are not a member of a couple, and do not have a dependent child, at the time of claiming, or. $45000 if: you are a member of a couple at the time of claiming, and.

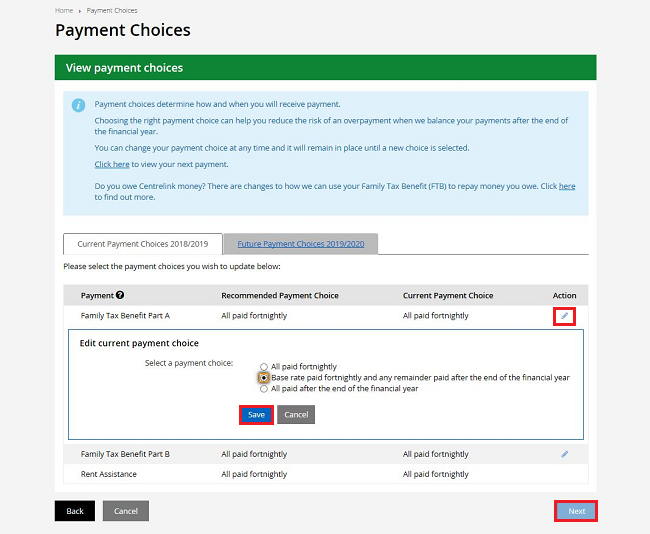

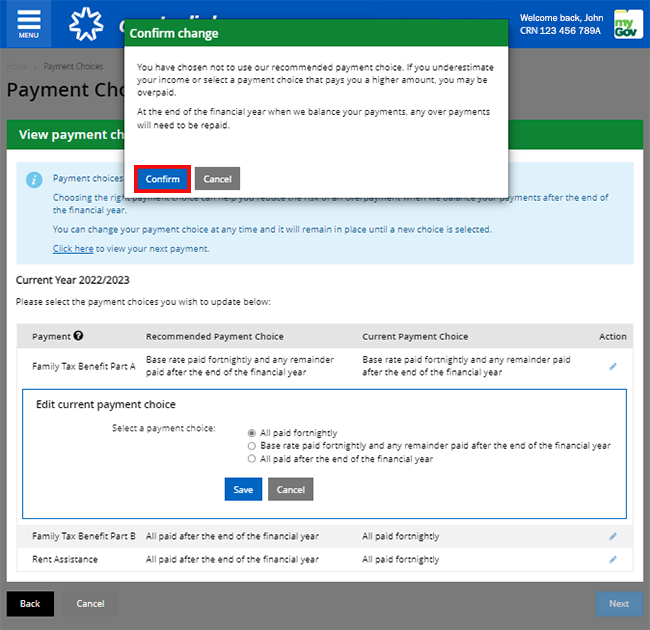

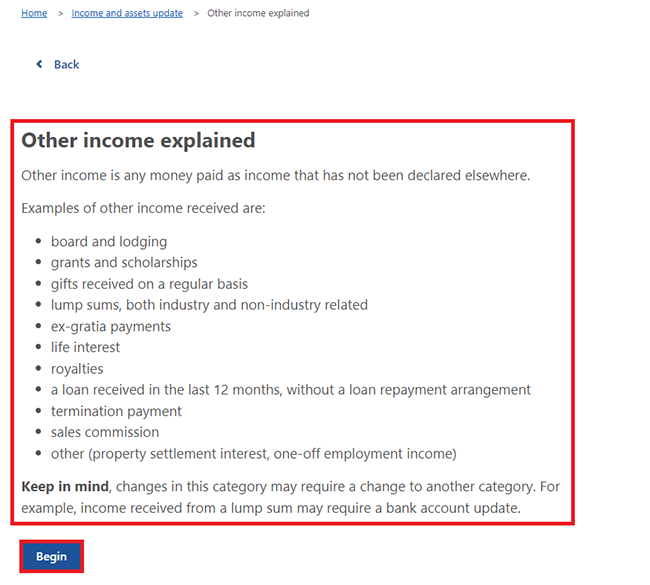

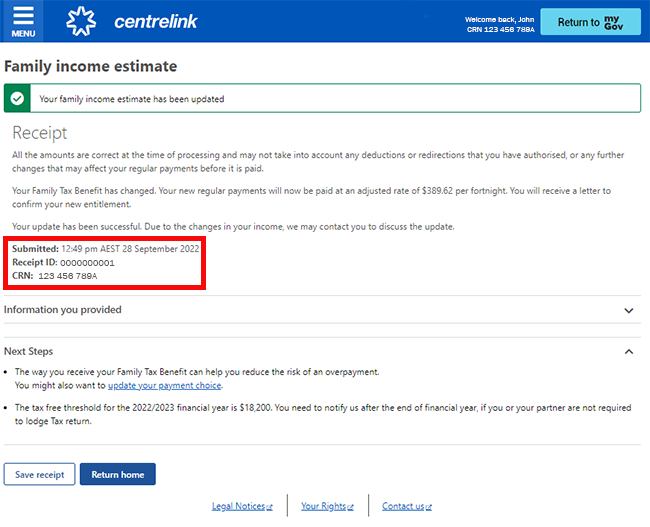

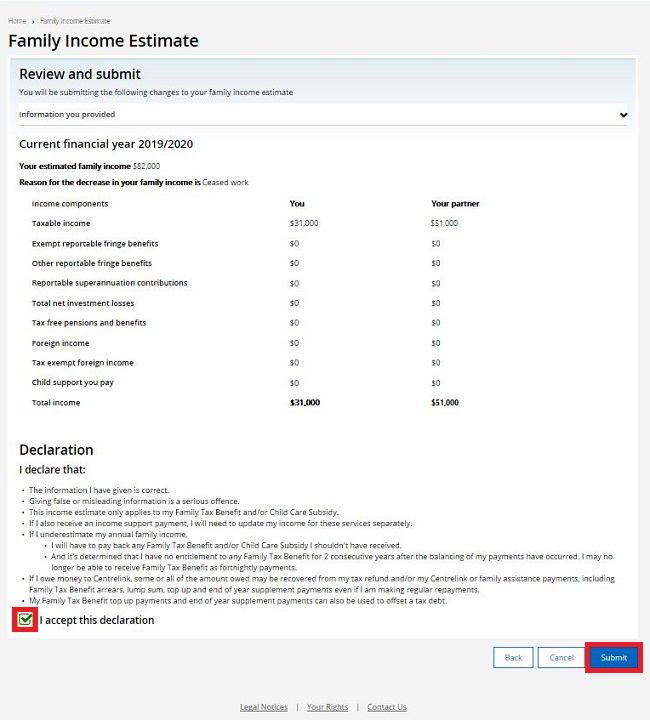

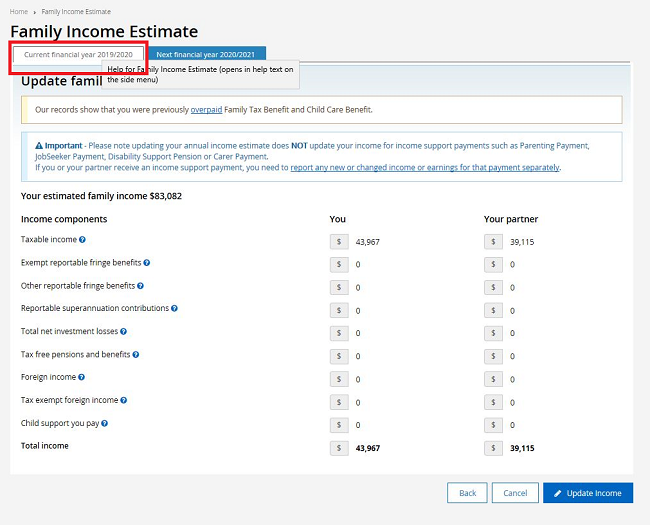

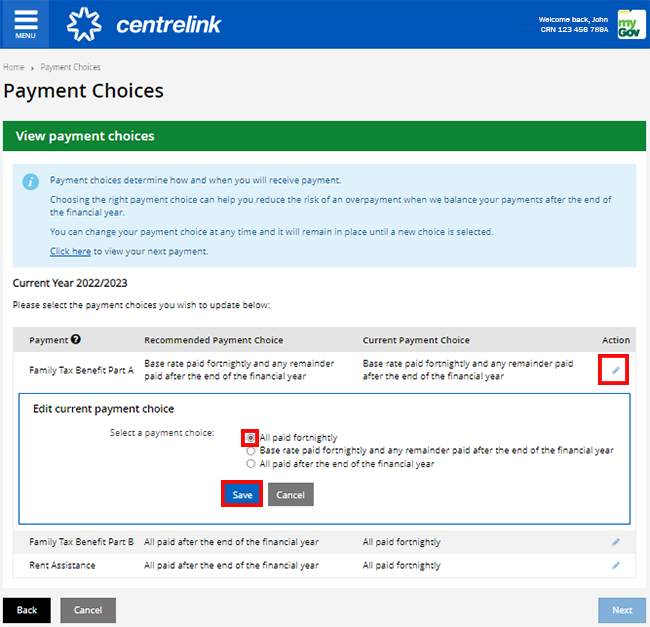

Centrelink online account help Update your family estimate and payment choice

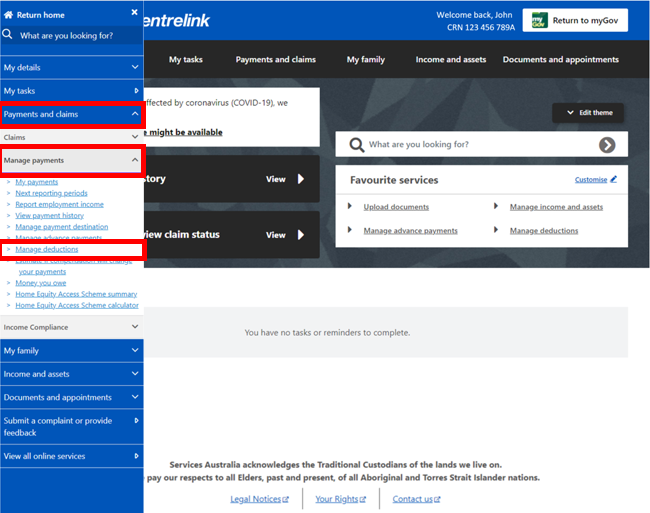

Centrelink online account help Deducting tax from your payment Services Australia

Centrelink online account help Advise nonlodgement of tax return Services Australia

Centrelink Payment Rates atotaxrates.info

Services Australia on Twitter "Now tax time is here you may be looking for your Centrelink

Manage where your payments are sent Centrelink online account YouTube

Express Plus Centrelink mobile app help Update your family estimate and payment choice

Express Plus Centrelink mobile app help Update your family estimate and payment choice

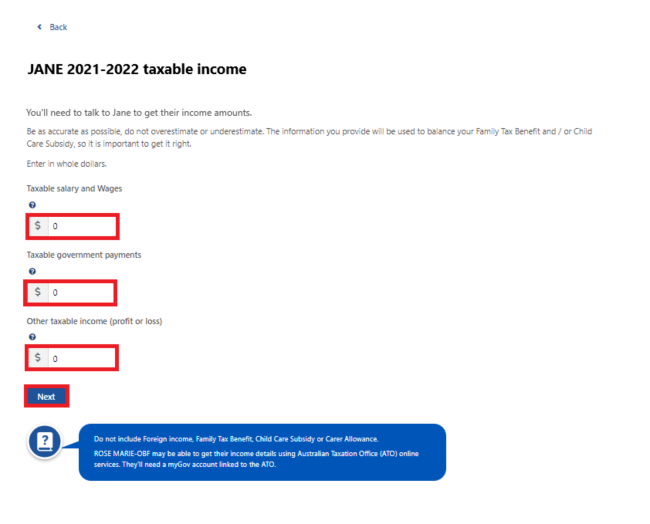

How Do I Report My Business To Centrelink Marie Thoma's Template

Centrelink Payment Rates atotaxrates.info

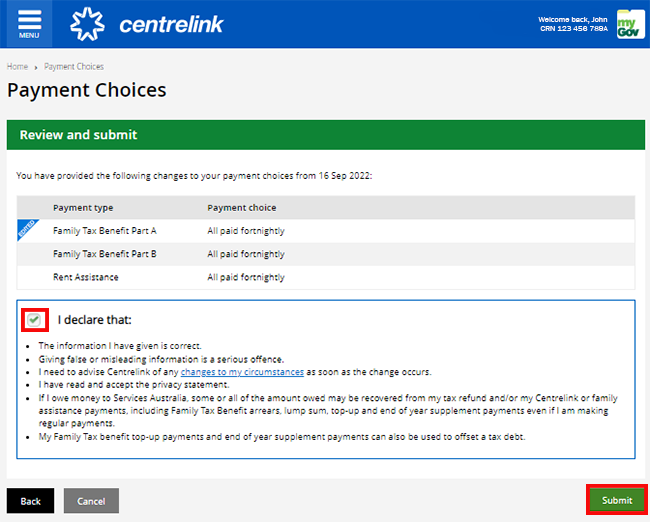

Centrelink online account help Update and assets details your other details

Centrelink online account help Update your family estimate and payment choice

Centrelink online account help Update your family estimate and payment choice

Centrelink online account help Update your family estimate and payment choice

Balancing your Centrelink family payments at tax time MEDIA HUB

Queen’s public holiday to impact Centrelink payments

Centrelink payments increased

Express Plus Centrelink mobile app help Update your family estimate and payment choice

Sample Centrelink Statement DSP PDF

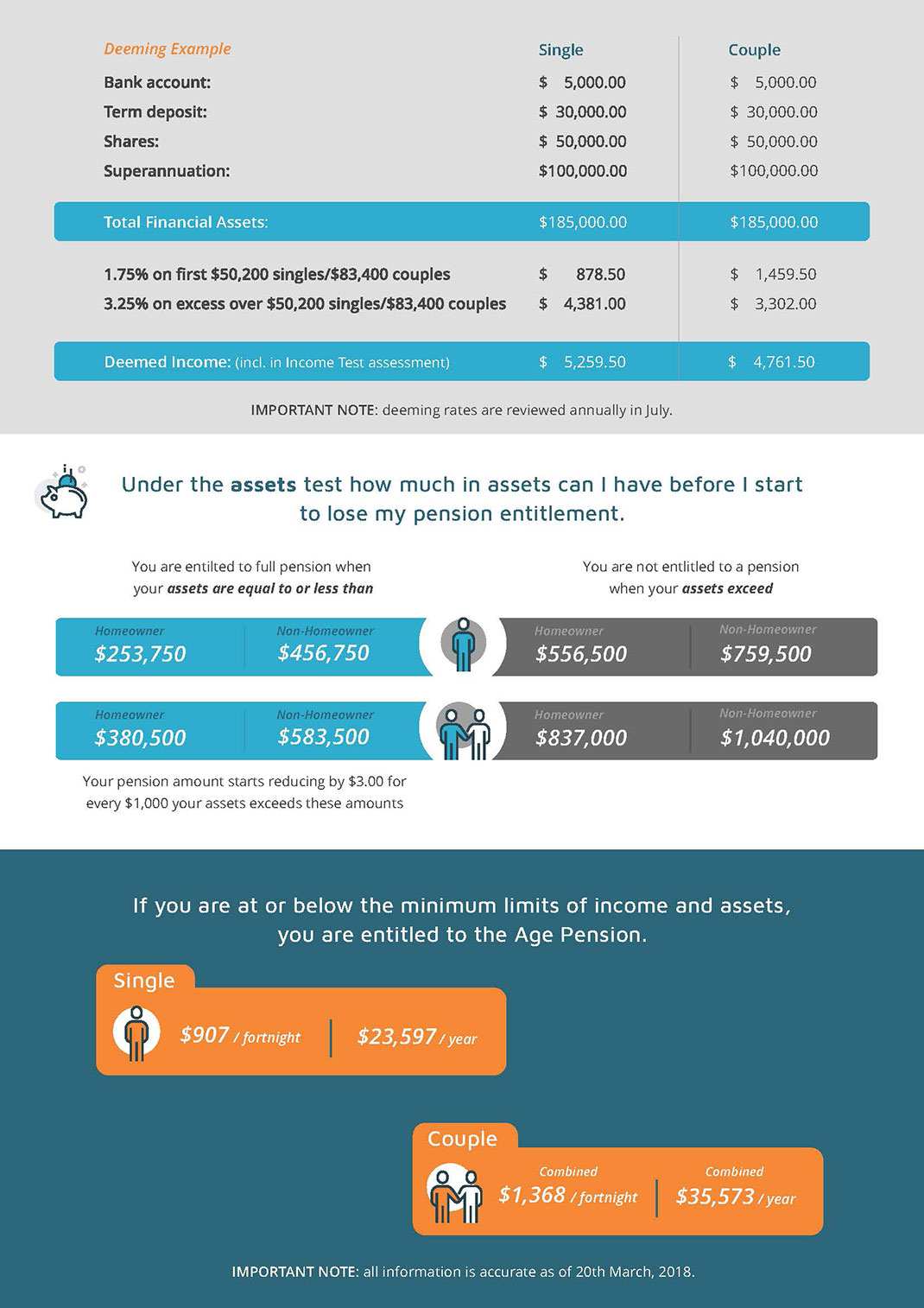

Understand how Centrelink calculates the Age Pension payment amount — Retirement Essentials

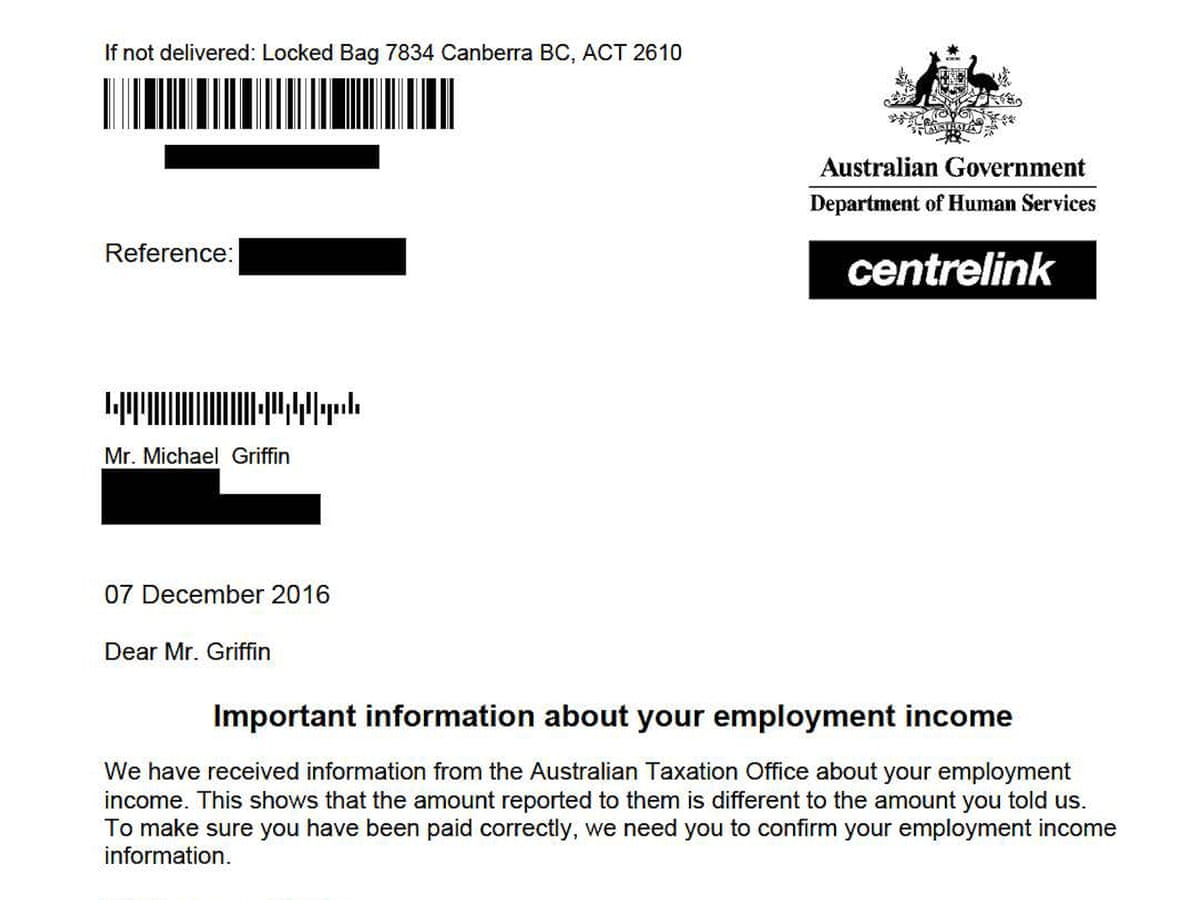

Centrelink income support payments. The following payments are income support payments: Special Benefit, you may get this if you're not eligible for any other income support from us. The following allowances are income support payments: Youth Allowance you may get this if you're 24 or younger and a student or Australian Apprentice, or 21 or.. If your only income for a tax year is the allowance you are claiming, you may not have to pay any tax. However, you may have to pay tax if you received or will receive any other taxable income in the tax year, such as salary or wages. If you think you will need to pay tax, you can ask Centrelink to deduct tax instalments from your payments.